Bold Moves Lead To Big Wins For Entrepreneurs, with Lisa Larter

September 16, 2024

Hosted By

Dan Sullivan

Dan Sullivan

Lisa Larter has a strategic marketing firm, providing consulting services around strategy and business advisement. Like many entrepreneurs, Lisa started off thinking she had to do everything herself. In this episode, she shares the wisdom she’s gained from using her growth mindset to gain continual business success.

Here’s some of what you’ll learn in this episode:

- The role of an entrepreneur in their business.

- The way in which Lisa’s background in retail helped her with marketing.

- The importance for entrepreneurs of understanding cash flow.

- How to make sure you’re prepared to pay taxes.

- What let Lisa know that her business idea “had legs.”

- The wisdom Lisa would impart to her past self.

- The variety of benefits Lisa has gotten as a member of the Strategic Coach® entrepreneurial community.

Show Notes:

The entrepreneur’s main capability is vision.

There are many talented people who don’t have a purpose or a vision for using their talents.

A lot of people understand sales and profit, but they don't understand cash flow and the timing and movement of money.

Meet as many of the right people as you can that you want to do business with.

People should aim to have a baseline—a certain amount of cash they want to carry in their business—and do whatever they can to avoid going below that number.

Entrepreneurs want freedom in their lives. And money buys you freedom.

Every entrepreneur needs some type of mentor, coach, or advisor that they can talk to when they have difficult things going on.

You will cap your potential if you don't learn how to lead and build a team.

If you’re entrepreneurial and you have a dream, it doesn't matter what your background or education is.

Resources:

The Self-Managing Company by Dan Sullivan

Episode Transcript

Dan Sullivan: Hi, this is Dan Sullivan, and I'd like to welcome you to the Multiplier Mindset Podcast.

It's a real pleasure for me to do this commentary around Lisa Larter. First of all, she mentions a little incident where she suddenly discovered that what she knows other people would pay to find out. The first thing I'm going to relate it to is the whole concept of Who Not How, which is a best-selling book on our part. It's a big concept in Strategic Coach. And what it says is that when you're growing a business, you as the entrepreneur have a vision for how it's going to grow. But where the entrepreneurs, for the most part, get caught up, the moment they see the vision, they feel emotionally committed to the vision. But they see 100% that they're going to have to be the person who does all the work to achieve the vision. I'd like to make a separation there. Your capability is vision.

I once saw a wonderful talk at another conference where a very successful real estate broker who had many, many realtors... And he talked about the first 20 years of his life where he wasn't successful at all. And then the last 20 years where he was amazingly successful. And he said, I just realized that there's many talented people in the world who can do great things, but these talented people don't have a purpose or a vision for using their talents. And that I, as the entrepreneur, I have the vision. I could give them purpose. And the moment I realized that I'm the one and my role in my company is to give vision to other people's purposes, all of a sudden, everything started working.

Lisa Larter: So my name is Lisa Larter. I am a Canadian living in Florida, and I have a strategic marketing firm. So I provide consulting services around strategy and business advisement, and I have a team who does marketing implementation. And I've been running this business, I think, since 2010, and this is my second year in Strategic Coach.

Prior to 2006, I worked for a company that you will be very familiar with, Telus. I was in charge of their corporate retail. I had a national scope of responsibility. My official title was Regional Sales Manager. And I left in 2006 after helping them get off the ground in '97 when it was Clearnet before they were acquired. And I opened my own Telus dealership. When I opened that dealership, one of the things that I had to do to market my own small business is, I had to learn a lot about marketing. And that was right around the time when social media was coming to the forefront and people were using Facebook and Twitter, and this was all new stuff. And I think because of my experience in the wireless industry, it was all really exciting and fun for me, and it was really easy to understand how to use it. When your background is retail, and you've had a lot of interactions with people in retail, you see tools like this as a new way to actually engage with potential clients and build relationships with people.

And so one day, I was at a networking event and somebody tapped me on the shoulder and said, you know, if you were to host a workshop or a training event or something to teach us what you know, we would pay you to learn. And it was an aha moment for me because I thought what I knew, everybody knew. Why would people pay me? And so I went to another networking event that day. There were 20 people in the room. I said I was looking for people who wanted to go to a workshop on how to use social media for your business. And 10 people in that room gave me money that day. They wrote me checks. They handed me cash. I didn't have a sales page. I didn't have a flyer. I didn't have all the details. All I had was an idea. And from that moment on, I realized that that idea had legs and that I could actually build a business around it.

The first year that I started that particular business, I think I generated a hundred and sixty some thousand in Canadian dollars, and now we do about 1.7, 1.8 a year in U.S. dollars. Advice for my past self would include, don't grandfather fees because as the market and the industry changes and things like inflation and pandemics and minimum wage go up, you're going to need to adjust your pricing. And so I used to wear grandfathered fees like a badge of honor. So that's one thing that I would tell my past self. The second thing that I would tell my past self is, and I learned this really in the wireless industry and I carried it forward, but really understand cash flow. Because a lot of people understand sales, and they understand profit, but they don't understand cash flow and the timing and movement of money. And so I think that is really important.

And then the third thing that I would tell my past self is, meet as many of the right people as you can that you want to do business with. I think there's this period in time when you start a business where sometimes you're a little bit conservative in terms of how much money you invest in being in programs like Strategic Coach or going to events. And what I have found over the years is, the bigger the ticket item I invest in in my business, the bigger the reward that I typically get from showing up and doing it. And so I probably would have told myself to take those risks sooner. I waited probably about five years before I started being really brave about those things.

If you don't understand what cash flow is all about, you need to learn. And so I'm going to go back to my retail store. I opened in November of 2006, and I ordered all of this inventory for the busy Christmas season after coming from the corporate world. And at the end of January, I got this bill from Telus, and I didn't have the money to pay the bill. I didn't understand how come I owed all that money because I didn't understand the movement and timing of money. So I worked with someone who developed a cash flow spreadsheet for me so that I could put all of the inputs for when money was hitting the bank, when money was going out of the bank, and I could see any day of the year how much money I should have in the bank. And he did all this beautiful work for me, and I took it home and I deleted it all and I redid it myself because I really needed to understand the flow. So if you don't have a cash flow spreadsheet or a tool to help you understand that movement, get one.

The second thing that I would say is, you know, there's a book a lot of people have read. It's called Profit First. It does a really good job of talking to people about how to segregate money, which I think is smart. I don't do it the way that he recommends because it's just way too many bank accounts and I think that simplicity is far better than complexity, but I think people should aim to have a baseline, a certain amount of cash that they want to carry in their business and do whatever they can to never go below that number. So if, for example, you know that it costs you $25,000 a month to operate your business, then I would say you should have $100,000 to $150,000 in cash in the bank at any given time. Because if something like the pandemic happens, or you get sick and you're not able to be in your business full time, or you lose customers unexpectedly, you at least have a nest egg there that can carry you through that time. And so a lot of people don't do that.

And then the final thing that I would say is really, really, really understand what you owe in taxes. In the work that I do in coaching and advising business owners, I cannot tell you how many times I have seen people spend money in their business bank account because they didn't understand what they were going to owe in taxes. They didn't pay regular installments or they didn't have an understanding of what that was going to look like. And so what happens is, if you wait until March to find out what your business owes in taxes from last year, and you've already spent that money, now you're into the first quarter of the next year and you're behind the ball. So I always go to my accountant at the beginning of October, and I ask him to do projections around what he anticipates my tax obligation will be before the end of the year so that I can make sure that I've got the cash flow and I'm accurately prepared for that and not surprised by it.

When you get paid, set the money aside and don't spend it. Because if something goes wrong in this project, because it's something new for you, and you want to be able to exit it, you want to be able to give your customer their money back. And too many people spend the money, and then they don't have the freedom to walk away from something because they've spent the money. And really, why are we in business as entrepreneurs? We want to make a difference, but we also want freedom in our life, and money buys you freedom.

I think every entrepreneur needs some type of a mentor, coach, or advisor that they can talk to when they have difficult things going on. And so, they should look for an outside party who's not emotionally attached to what's going on to seek perspective. And I think that that is something that can be immensely helpful. A lot of times, you know, entrepreneurs feel like they have to do it all alone. I'm a huge fan of Dan's book Who Not How. And so I think sometimes we get stuck in the "How," and when things are hard, we really, really dig down deep into the "How." And really, sometimes we need a "Who" that maybe knows what needs to be done or a "Who" that can share perspective in a different way that can help us get out of the spiral that we've put ourselves into.

I had been thinking about Strategic Coach for a number of years, but being Canadian and spending half my time in the United States, the travel kind of felt like a little bit of an issue to me. And I really wanted to do in-person. I didn't wanna do online. I had some other communities that I was part of that weren't necessarily serving me as well as they once did. I was a little bit bored with those communities, and I was looking for something new. A couple of members of Strategic Coach spoke very highly to me about Coach, and a couple of them really told me that they felt like I would benefit and that I would get a lot out of it, that I would build great relationships and especially given that I'm not a "solopreneur," I have a team, that there would be a lot of tools and resources that I would get.

And so I don't remember the exact state. I didn't join to solve a problem. It was more, I was looking for something new because I believe in investing in my own professional development. And so what's changed, though, is I've met a great network of people, and the consistency of showing up every single quarter and thinking about my business and having conversations with my business has just benefited me in a bunch of different ways. It's benefited my company in terms of my team culture and really getting our team to focus on wins. It's benefited me in making decisions, I think, a bit faster than what I would have made previously when it comes to maybe employee issues. And I've just built some really great relationships with people, which is fantastic.

I have 10 employees, and we have up to 10 freelancers that work with us at any given time. So 10 employees, including myself. And then, we have freelancers for kind of overflow. When we're more than at capacity, we have freelancers that can jump in and help us. And when we get to the next level of using our freelancers too much, then we'll hire another employee. And so it's kind of a good balance of having both. It wasn't until, I think, I was 350,000 that I decided to hire somebody to help me. I hired my first employee and that was a fail. She was a wonderful, wonderful woman, but she hated working from home. I wanted a remote company. So then from there, I started to hire more freelancers because I wanted people that didn't want an in-office job. And then as we continued to grow and I had more freelancers, I realized that I needed more commitment and dedication from people. And so then I started hiring employees.

You will cap your potential if you don't learn how to lead and build a team. I also believe you need to make smart financial decisions because you can overhire and bankrupt your business. So again, you need to understand cash flow, you need to understand your numbers and the finances, the economics around hiring, but you only have so much time. And if you want to build a business that can operate without you, if you want to build a Self-Managing Company, you can't do it alone. So if you're the type of person who just really, really wants to be a "solopreneur," I'm going to say Coach is probably not for you. You know, that's what really attracted me to Coach was the promise that we'll help you build a Self-Managing Company. And I think that you have to want that and you have to know that you can't build a Self-Managing Company without other people to manage it. And so you pretty much need to be willing to hire.

So I think what is important for people who are listening to this to know is, I'm a high school dropout and I grew up with a single mom who lived under the poverty line. And if you are entrepreneurial and you have a dream, it doesn't matter what your background is, what your education is. What matters is your work ethic and your willingness to learn. I believe that it's really possible for anyone. And I also believe that organizations like Strategic Coach actually help you achieve results and get there faster. So don't be afraid to invest in yourself. In fact, the person you should invest the most in is you. You can learn anything online. There's no excuse today. There's no reason for people not to learn the competencies and capabilities and skills that they need to be successful if they're committed. And so we need to be mindful of what we're consuming because you can consume a lot of garbage out there or you can find some stuff that can really change your life.

Dan Sullivan: So Who Not How applies to other "Whos" who do the "Hows" for your goals. But in becoming a very successful entrepreneur, and you've learned certain things, and Lisa has just mastered how you have to pay attention to cash flow, and she's really mastered how you pay attention to taxes. I might say also that she's learned the difference between the value of a Canadian dollar and the value of an American dollar, which we learned a long time ago. The whole point was, I can see myself that Lisa would be a joy to have in a coaching session where she's the coach and just gets people to think through how they create freedom for themselves as entrepreneurs just by paying attention to the things that really matter. And cash flow—I often say, if there's a God in the entrepreneurial heaven, the name of that God is cash flow. That you only have freedom as an entrepreneur to the degree that you're confident about your cash flow and also confident about the cash flow that has to pay taxes.

When we first teach people in Strategic Coach how to look at the team who directly supports them as an entrepreneur, the subject of money immediately comes up and they say, well, it's gonna cost $50,000 for that person. And I said, yeah, there is an amount of money called $50,000. But it's not a cost, if you think about it properly. It's actually an investment. And then people will say, well, how do I know if the person's a good investment? And I said, well, that's not the big concern. It's not whether the other person is worth the $50,000. The question is whether you are worth the $50,000 you're going to invest in this other person because you're not actually investing in them, you're investing in yourself, from the logic that if this person does what I think they can do, they'll free me up and I can very easily make $100,000, $150,000, $200,000 to pay for the $50,000 investment.

So I never see my team members at Strategic Coach as a cost. They're all investments. We started with two or three, and now we have 130. And I don't see any of them as a cost. I see them all as investments who free me up, they free Babs Smith, my partner, up, and everybody's freeing up other people by being great at what they do. And I think Lisa has just totally aced her understanding of this way to grow as an entrepreneur.

Related Content

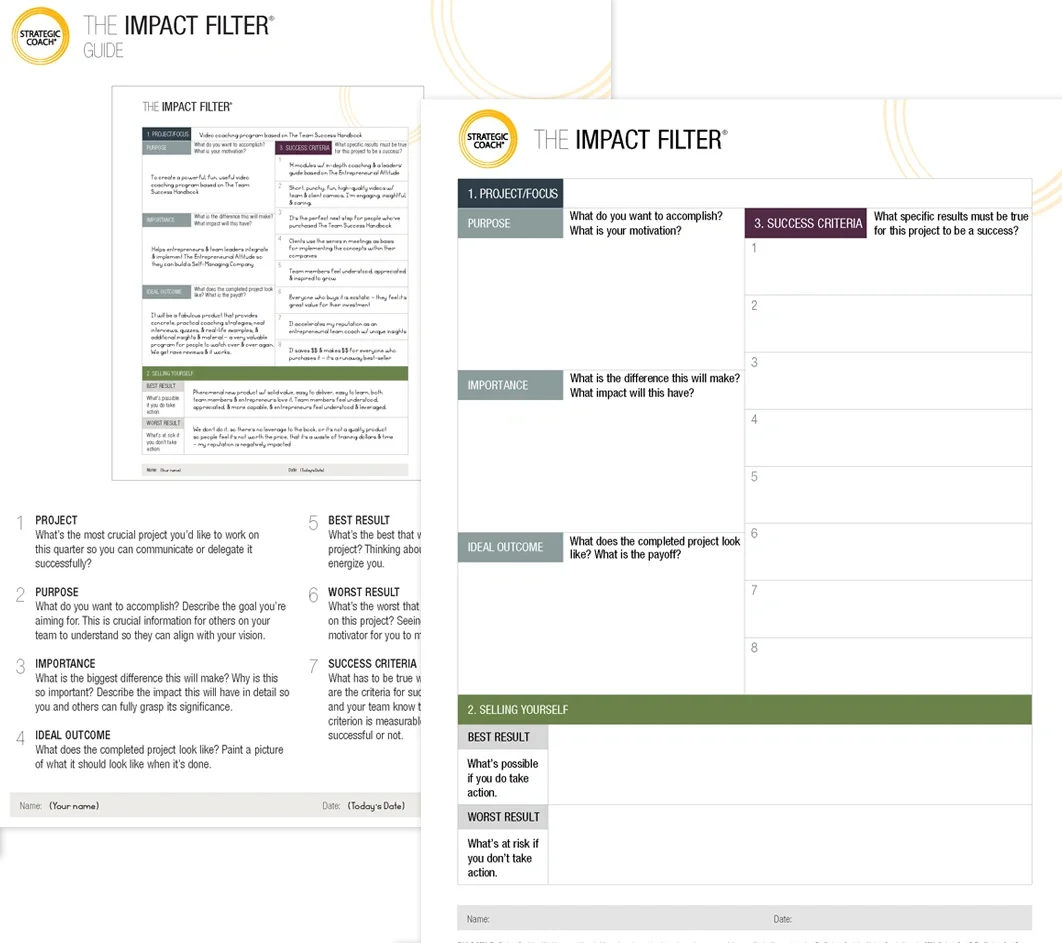

The Impact Filter®

Dan Sullivan’s #1 Thinking Tool

Are you tired of feeling overwhelmed by your goals? The Impact Filter is a powerful planning tool that can help you find clarity and focus. It’s a thinking process that filters out everything except the impact you want to have, and it’s the same tool that Dan Sullivan uses in every meeting.